Ensuring companies and customers receive their goods safely and timely is an important part of helping businesses operate efficiently and successfully. Organizations must track and analyze the costs associated with transferring goods. Freight accounting allows companies to better understand their expenses and identify areas where they may be able to cut costs. In this article, we discuss what freight accounting is, why it’s important, freight in and freight out, freight on board and factors affecting freight costs.

What is freight accounting?

Freight accounting is accounting that tracks the expenses associated with sending goods from one location to another. Sometimes freight is shipped from a manufacturing warehouse to the warehouse of the company selling the items, or items may travel from a company to a retail location or directly to the customer.

Freight can travel by various modes, including:

-

Truck

-

Plane

-

Ship

-

Train

Depending on the nature of the shipment and the agreement between the sending and receiving parties, the freight costs may be paid before or after the items are shipped. Businesses record their freight costs differently depending on which party is paying for shipping and whether the items’ cost includes shipping fees.

For example, if a particular item is out of stock at a retail store and needs to restock their inventory, they may pay freight costs and count these as inventory expenses. Other companies that agree to pay shipping fees to send items to customers may account for these costs under their general expenses.

Why is freight accounting important?

Freight accounting is important because it can provide insights into your company’s spending. Some of your organization’s freight costs may be negotiable or modifiable, allowing you to save money. To identify these areas, your accounting team must track freight costs accurately. With a comprehensive picture of how and where you’re spending money, you can more easily develop solutions to increase efficiency and reduce costs.

If freight accounting is a significant part of your business, consider creating a separate account for freight costs that you can easily access and manage. You can input all fees associated with shipping goods to customers or other companies.

Additionally, it’s important to ensure your company’s shipping and accounting practices comply with all regulations, including environmental and tax regulations. Your company should:

-

Maintain accurate financial records.

-

File all necessary documents with governing authorities.

-

Obtain any relevant permits.

-

Store records securely and safely.

-

Audit your records regularly.

-

Implement controls to safeguard your data.

-

Stay updated on all local, state and federal guidelines.

What is freight in vs. freight out?

Freight is typically as either freight in or freight out:

Freight in

Freight in refers to a transaction in which the buyer of goods pays for freight costs. The fees for transporting the goods are considered part of their purchases for accounting purposes. The cargo becomes the property of the buyer once it is loaded onto the mode of transportation, meaning that the buyer assumes all the risks of transporting the freight.

Freight out

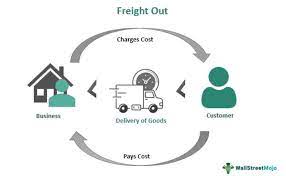

Freight out refers to a transaction in which the seller covers all freight expenses. The seller generally accounts for these costs as part of their business expenses. These expenses are subtracted from gross profit to determine net income.

Example of freight in and freight out

HMS, Inc. is a manufacturer of children’s books. Hometown Books is a chain of retail book stores that orders a large shipment from HMS, Inc. The contract states that Hometown Books will pay the costs to transport the books from the HMS factory to the book stores throughout Ohio. In this exchange, Hometown Books considers this transaction freight in because they paid freight costs as the buyer of goods.

What is freight on board?

Freight on board (FOB), also called free on board, is a shipping expression created by the International Chamber of Commerce that describes which party is responsible for shipping costs and when a seller officially transfers ownership of the goods to a buyer.

What is free on board origin?

Free on board (FOB) origin, also called FOB shipping point, denotes when buyers are responsible for freight costs. Sellers are responsible for any fees associated with the freight before it reaches the shipping point, such as taxes or customs fees. Typically, FOB origin occurs when companies ship to a retail store or vendors.

What is free on board destination?

Free on board (FOB) destination means that the seller of good retains ownership and assumes the risks of transportation until the cargo reaches its destination, at which point the buyer takes over ownership. FOB destination often applies when companies ship to a warehouse, port or other major shipping location.

What affects freight costs?

Multiple factors affect how much it costs to transport goods, including:

-

Mode of transportation: The type of transportation, such as truck, airplane, ship or train, affects the costs freight companies charge customers.

-

Weight of cargo: Heavier loads cost more to transport than lighter loads due to additional fuel costs and extra wear on the mode of transportation.

-

Fuel: Fluctuating fuel costs can result in higher or lower freight costs. When fuel costs rise, freight companies often charge more to offset these expenses, whereas lower fuel costs can lead to cost savings for companies transporting goods.

-

Demand for freight: If there is a high demand for freight carriers, freight companies can charge more for their services. Less demand often leads to cheaper rates for clients of freight companies.

-

Risk: Traveling through dangerous conditions or areas or transporting hazardous material can increase freight costs.

-

Regulations: Certain government regulations that affect transportation can affect freight costs, including limitations on driving hours, emission tax laws and reductions in cargo volume.

Leave a Reply