A merger can be an exciting opportunity to join two companies or entities together to improve operations or profit margins. They can be challenging for employees who may not understand how restructuring can affect their jobs. Learning about different types of mergers can help you prepare for a similar situation occurring at your company. In this article, we discuss what a merger is, and how it affects your career, and list eight different types of mergers.

What are mergers?

A merger is a process of joining two companies together into one legal entity. Companies can negotiate mergers between two companies that want to combine their structures to become more competitive in their industry. They can combine resources and customer base, creating a larger market share between one new legal entity. The negotiations about combining the resources determine what kind of merger the companies engage execute. This process can include sharing financial information, disclosing business strategy, and evaluating each department and its contribution to the overall profit of the new entity.

How can mergers affect your career?

As an employee, a merger can mean changes in the company you work for, including management structure and industry focus. It can be a stressful event for some, but can also be an exciting opportunity for change:

Restructuring

When companies merge, they restructure their management teams and departments to become one company. This can mean removing redundancies in departments, which may lead to layoffs. It can also mean new positions created within the department to oversee larger teams or facilitate new initiatives. Pay attention to changes in management, and be sure to take on new tasks assigned to you to show that you are a valuable member of the team and can handle any opportunity that the restructuring may present.

Change in environment

Mergers can mean a new company culture and a change in industry or business strategy that can affect how you perform your job. When two companies join together, employees may interact with new human resources professionals and change the health insurance or benefits the company offers, which can affect the work environment. You may also experience a change in expectations for your role. After a merger, some companies invest in new offices to compensate for the increased workforce.

Capital gains

Mergers can increase the value of the new legal entity’s stock because it has accumulated more resources than either of the previous companies had. When an employee owns some of the company’s stock, which may be one of the benefits the company offers to its employees, they may earn capital gains from the increase of their stock’s value. This can be additional income for an employee.

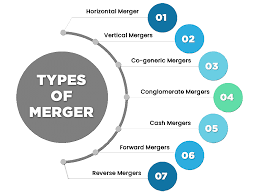

8 types of mergers

Here are eight merger types you may encounter in business:

1. Horizontal merger

A horizontal merger is when two companies that were previous competitors selling the same product or service join together. They combine their resources to increase their joint market share within their industry instead of competing with each other. This type of merger typically includes two smaller companies with similar products, customers, and target markets. The new legal entity can set prices higher because they’ve eliminated some of their competition by merging with them.

2. Vertical merger

A vertical merger is when a company merges with one of its suppliers or distributors to include that section of the production process into its own company and control. These types of mergers can give the company more control over its supply chain, increasing speed, quality control, and flow of information through the supply chain.

For example, if a Clothing company buys a clothing manufacturing factory instead of hiring them to construct their garments, they have merged vertically with another entity in their supply chain. The clothing company can save time negotiating with a third party on prices reserving materials and time.

3. Congeneric merger

A congeneric merger is a merger where two indirect competitors with different products but similar target markets merge to gain access to each other’s customer base. These companies often share similar distribution channels and production processes, so these mergers can help companies grow their market share within their existing markets by combining with competitors.

4. Market extension and product extension merger

A market extension merger is a merger between companies that sell the same product or offer the same service but compete in different markets. These mergers allow the new legal entity access to both markets, increasing the profit for both by accessing a more extensive customer base overall. These mergers can happen between companies in different countries or industries. For example, if a company believes its product can be successful in the market of a different country, they can merge with another company with an established presence in that market to gain access.

5. Conglomerate merger

A conglomerate merger is a merger that occurs between two companies whose business is unrelated. Both original entities can continue functioning in their markets and operate independently. They may use their combined resources to venture into new markets or industries. This type of merger can help a company access new industries and markets they wouldn’t have had access to before without changing their successful operations within their existing industries. Company environments may clash during a merger of this kind, but profits and stock prices may increase for both companies as they combine their industries.

6. Acquisition

An acquisition is when one company buys another company to obtain its assets or resources. The difference between an acquisition and other types of mergers is that the purchasing company absorbs the acquired company instead of creating a new legal entity. The owner of the buying company becomes the owner of the acquired company, and the acquired company ceases to exist. During an acquisition, the structure of the acquired company is restructured to fit the needs of the buying company so that the purchasing company may phase some departments or employees out of the structure.

8. Acquisition of assets

Acquisition of assets is when one company acquires the assets of another company rather than absorbing the company as a whole. This type of acquisition typically occurs when one company declares bankruptcy. During bankruptcy proceedings, companies sell assets under market price to pay their debts. A company may acquire another company’s technology, equipment, land, or intellectual property to add to its assets. The original company may pay off its debts or be liquidated and cease to exist. The purchasing company can continue to expand its business with its acquired assets.

Leave a Reply